Consumer Financial Protection Bureau housekeeping risks release card protections

We urge the CFPB to keep release cards in mind when revising regulations so they don't unintentionally undermine their own reforms.

by Stephen Raher, August 15, 2017

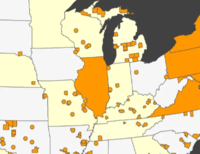

Yesterday we filed comments with the Consumer Financial Protection Bureau to point out how their recently proposed amendments would inadvertently impact their regulation of financially abusive “release cards.” Release cards are prepaid debit cards that prisons and jails use (instead of checks or cash) to refund money that is owed to someone upon their release from custody (for example, accumulated wages from a prison job, or money that a person had in their possession at the time of arrest). Such cards usually cost the correctional facility nothing, but the issuing financial institution makes money by charging numerous excessive fees to the cardholder.

In 2015, the CFPB conducted a rulemaking to create greater protections for all types of prepaid cards. Prison Policy Initiative submitted comments asking the CFPB to prevent correctional facilities from forcing someone to accept a release payment in the form of a prepaid card. Although the CFPB did not adopt this recommendation, it did issue a comprehensive new rule in 2016, and in the process clarified that release cards are covered by many other consumer-protection provisions of that rule.

In June of this year, the CFPB proposed some housekeeping amendments to the 2016 rule. Although these changes are well-intentioned, we spotted some loopholes that could have unintended adverse impacts on release-card recipients. For example, the 2016 rule requires card companies to provide protections for people whose cards are subject to fraudulent use. The financial industry asked that these protections only apply if cardholders first verify their identity with the issuing bank, and the CFPB agreed to propose such a modification. This may make sense in the case of a prepaid card that someone buys at a convenience store, because the card-issuing bank has no idea who their customer is. On the other hand, when someone is released from prison and given a prepaid card, that person’s identity is already established. Forcing that person to sit on hold or go to a website to register the card makes no sense, and we pointed this out in comments we filed this week with the CFPB. Our concerns were echoed in a comment submitted jointly by the Americans for Financial Reform, the Center for Responsible Lending, the Center for Digital Democracy, Consumers Union, the policy and mobilization arm of Consumer Reports, the National Consumer Law Center, U.S. PIRG, and the Woodstock Institute.

We also used this opportunity to once again urge the CFPB to conduct a broader proceeding to draft rules targeting the wide variety of unfair financial products (like money transfer services) that are forced on incarcerated people and their families.

There is no definite timeline for the current rulemaking, but the rules that were originally issued in 2016 are due to become effective in April 2018. Presumably the CFPB will make a decision on the current round of amendments sometime before the effective date.