Thoughts on processing fees in the jail telephone industry

Some additional observations about prison phone fees, based on discussions we had with the phone companies after the report’s release.

by Peter Wagner, May 29, 2013

In our report, Please Deposit All of Your Money: Kickbacks, Rates, and Hidden Fees in the Jail Phone Industry, we catalog the many fees customers pay at every step of the way, including fees for making deposits, keeping accounts open, and getting refunds. Our report puts these fees in a larger context, and discussions we’ve had since the report’s release lead us to some additional observations about fees. In our report, we wrote:

In our report, Please Deposit All of Your Money: Kickbacks, Rates, and Hidden Fees in the Jail Phone Industry, we catalog the many fees customers pay at every step of the way, including fees for making deposits, keeping accounts open, and getting refunds. Our report puts these fees in a larger context, and discussions we’ve had since the report’s release lead us to some additional observations about fees. In our report, we wrote:

To be sure, businesses in many industries incur some processing costs by accepting credit or debit cards in person, via the internet, or over the telephone.65 Businesses usually respond by setting minimum purchase levels for a take out food order, charging a slightly higher rate per gallon of gasoline, or by simply writing it off as the cost of doing business. But this section of the report suggests that prison telephone companies may be approaching the question from the other end: providing telephone services in order to make money by charging extra fees. Indeed, because the commission system reduces the potential for corporate profit from the telephone calls, fees that should be no more than supplemental income are turned into a central source of profit.

Of the companies we singled out for criticism, one might not have deserved it in a report about prison telephones. In our tables, Turnkey Corrections is tied with Global Tel*Link for having the highest credit card fees, but it turns out that Turnkey both encourages no-fee cash payments and isn’t really in the phone business.

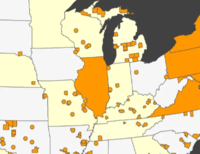

Turnkey told the FCC in its Wright Petition filing that “TurnKey is a small provider of inmate commissary, vending, phone services and video visitation services to approximately 70 jails in the Midwest and Northwest.” Of those 70 contracts, only one is a phone contract. Turnkey’s main focus is on providing commissary services to 70 facilities, and video visitation to a large subset of those facilities. So, while Turnkey is relevant to discussions about video visitation, it is not a very important player in the telephone market. Future discussions should instead include additional companies like City TeleCoin, which has been working with Securus to fight Louisiana’s attempts to ban deposit fees.

But there are additional lessons to be learned here. When Turnkey representatives reached out to complain that their company was criticized in the report, they shared some information about how their prison commissary business works that casts some light on the financial transactions of the loved ones of incarcerated people that should be relevant to the FCC’s deliberations on industry regulation. (The facts that follow are from my interview with Patrick McMullan, Vice-President of TurnKey Corrections / TurnKey Correctional Supply / Three Square Market, but the conclusions are ruminations are mine alone.)

- Fees interfere with commerce. Turnkey told me that they carefully studied their commissary business to gauge the effect of transaction fees on cash deposits. They found that after deposit fees are removed, sales go up.

- Cash is popular. Turnkey operates payment kiosks in jails where loved ones can deposit money. Turnkey reports that 70% of the company’s deposits are made in cash, and that 97% of cash deposits are made at kiosks where there is no fee. (The company told me the exceptions are in places where additional machines were installed at the facility’s request, and that the fees are temporary recovery of the kiosk installation costs.) An important question for the other companies is what no-fee deposit options they offer and how much of their deposits in number and by aggregate value are made in various formats. We expect that this answer would vary greatly between the companies.

- Small deposits are the norm. Turnkey told me that the average cash and credit deposit is about $40, and that they find that the average incarcerated person will spend about $120 per month on commissary and communications. This information is invaluable to a government regulator seeking to determine if fees are being charged inappropriately. It would be helpful to see if other providers in the jail context report similar figures, and if the payment practices are substantially different in state and federal prisons. Similarly, because we note that Global Tel*Link says that payments under $30 “may be charged a $5.00 processing fee,” it would be useful for that company to share how often they charge that fee.

Interestingly, of the three providers that we discovered had both a transactional limit and a monthly/weekly deposit limit, we note that Turnkey’s two limits were not very far apart: Turnkey accepts up to $400 a month, in deposits capped at $150 each. ICSolutions, on the other hand, accepts $275 a month in increments of up to $50 at a time, while AmTel allows $250 a week in individual deposits of up to $100. That means that if someone were to spend the maximum allowed on funding the phone account, AmTel would collect the fee about 10 times ($69.50-$100 total) in a month, ICSolutions would collect a deposit fee 6 times ($42), compared to Turnkey’s 3 times ($24 total). Given that the companies are unlikely to set a maximum monthly/weekly limit lower than the expected usage of their services, the FCC should ask AmTel and ICSolutions some probing questions about how these limits increase the cost to consumers. - Some credit card costs might be legitimate, some might be fair, and some might be both. (Others are a stealth profit center.) Turnkey has one of the higher credit card charges in our survey, but the company clearly expects and wants people to deposit cash. And there may be instances when a consumer might prefer to pay a high credit card fee rather than drive to the jail to make a deposit in person. (For large rural counties or for individuals whose loved ones are jailed in another state, paying a high credit card fee could be an attractive alternative.) Turnkey also described their challenges with credit card chargebacks, which I concede could be part of the cost of accepting credit cards. But that raises a very real but simple question: are chargebacks more common in this industry than other industries? And if so, to what extent are the credit card chargebacks in the prison phone industry due to poor customer service? We might suggest — in advance of any company sharing their data on chargebacks — that the FCC grant more weight to the cost evidence presented by the companies with A ratings from the Better Business Bureau than should be granted to evidence presented by companies like Telmate that have an F rating.

the telephone system IC solutions is very expensive. customer service is very poor, when calls drop they will not credit the money back to your account if you are receiving calls on your cell, the representative says in order to get credited for a dropped call you must be on a land line phone which everyone knows is nearly extinct. Hopefully these companies can be investigated about rates, and recruiting accounts when calls are dropped regardless if it’s land line or cell phone.