Uncovering Securus’ profits

Securus exemplifies the industry's obscene penchant for squeezing profits by fleecing their customers and shorting their business partners.

by Peter Wagner, June 19, 2015

In general, Securus — a prison phone industry giant — is in a pretty profitable business. The company and its competitors vie for monopoly contracts to provide phone service in prisons and jails. Because the facilities demand a share of the proceeds, the incentive is to charge as much as the consumer — or regulators — can bear. But Securus exemplifies the industry’s obscene penchant for squeezing profits by fleecing their customers and shorting their business partners. As The Huffington Post wrote last week:

A presentation that the privately-held prison telecom company Securus made to investors that The Huffington Post obtained shows just how much money there is to be made as the state-sanctioned middleman between prisoners and the outside world: $404.6 million last year alone.

Securus, which provides phone services to 2,600 prisons and jails in 47 states, made $114.6 million in profit on that revenue in 2014. Securus’ gross profit margin — a measure of the difference between the cost to provide its services, and what it charges for them — was a whopping 51 percent.(*)

That’s not only unprecedented(**), it’s significantly higher than companies typically known for having high profit margins like Apple. And it’s certainly enough profit to buy up their rivals like JPay.

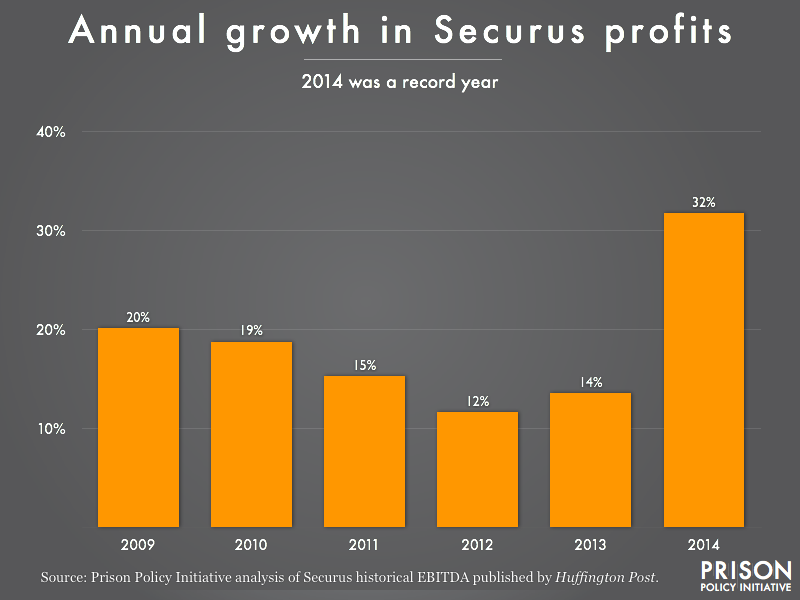

And these margins continue to grow. Our analysis of Securus’ profits from the investor slides reprinted by The Huffington Post shows the company’s profits took a huge leap upwards in 2014:

But what is driving these profits? Three shifts are likely behind Securus’ unprecedented profit growth:

- Securus stopped paying commissions on interstate calls. The FCC issued an order capping the cost of these calls and prohibiting companies from treating the commissions as a legitimate cost of the call. Securus has, apparently, chosen not to share any portion of their profits with the facilities, keeping the profits all to themselves.

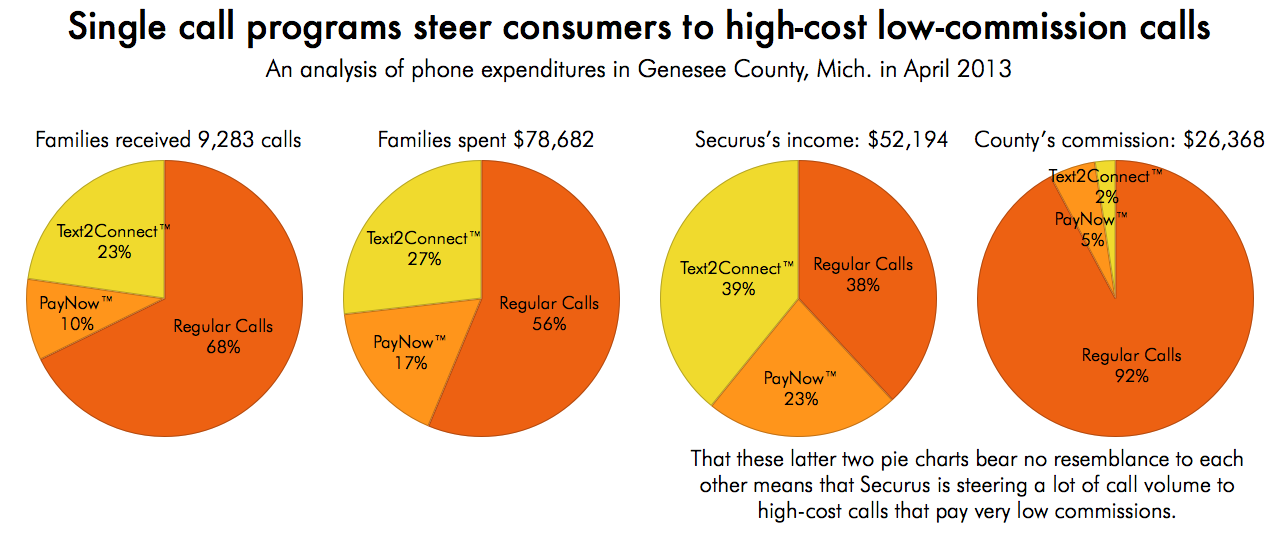

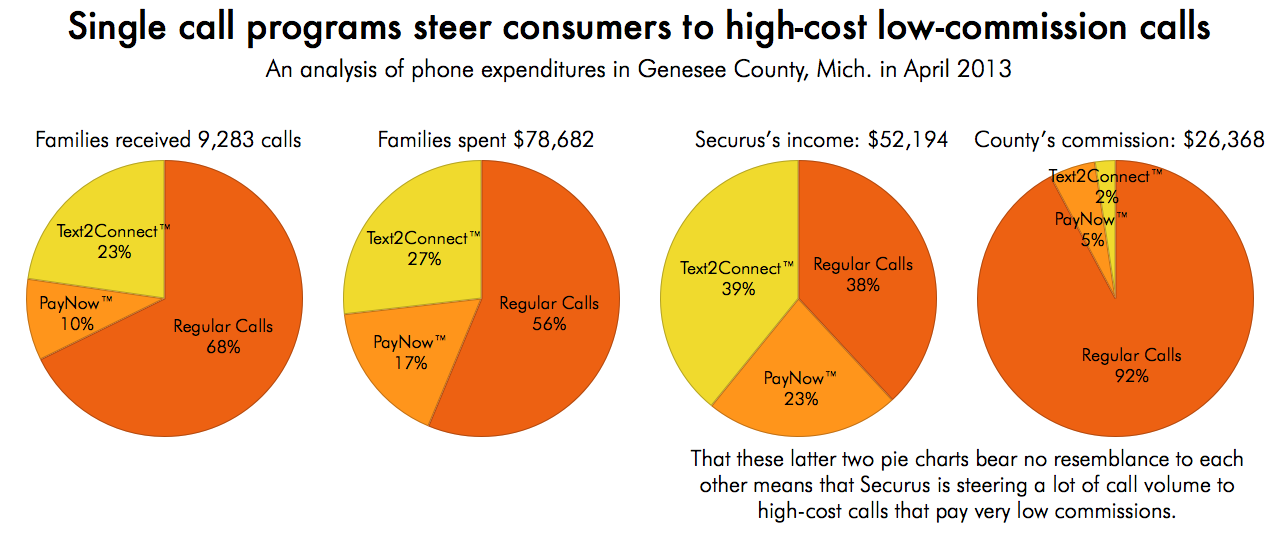

- Securus is steering a greater portion of their call volume from regular calls to abusive “single call” programs that charge $9.99 via premium text message or $14.99 charged to a credit card for each call. As we explained in our January 2015 briefing, these calls are responsible for a disproportionate share of Securus’ profits:

These charts show four views of three types of calls in Genesee County, Michigan: by volume, by the cost to families, by where Securus makes its money and where the County earned its commission. (And as we explain in a footnote to yesterday’s article, just the credit card calls earn Securus $24-76 million a year.)

- Securus has increased their typical(***) credit card deposit fee from $7.95 at the time of our report in May 2013 to $9.95 shortly thereafter. Since Securus disclosed that they charged credit card fees 4.8 million times in 2013, at $9.95 each in 2014, Securus revenue could be as much as $47 million from just credit card fees in their record profitable year.

As we explain in an article released yesterday, Securus’ business model is less about providing phone service than it is about harvesting fees. What this data shows is just how profitable that fee harvesting can be.

Notes:

(*) Securus challenges some of the numbers in the quoted Huffington Post paragraphs but Securus does not challenge the legitimacy of the investor slides published by Huffington Post.

(**) Because Securus is privately owned even seeing this data is unprecedented. The data on these slides shared with investors is also quite different from the story that CEO Rick Smith told the FCC last July (video at 208:45 seconds or transcript):

Page 198: 1 At some point in the presentation and 2 these discussions, I always get around to 3 discussing where I think we stand in terms of a 4 competitive company with competitive returns. And 5 I've heard three words during the session so far. 6 One is that rates are egregious. One is that 7 rates are abusive, and the other one is that rates 8 are predatory. I can look at our bottom line and 9 compare that to other companies' bottom lines. 10 Most of these companies you've heard of. And so a 11 few statistics before we can use any of those 12 words. 13 I looked at net income, kind of what you 14 can get from public statements, as a percentage of 15 profit. And here's the listing. Verizon was at 16 14.3 percent; not bad. Time Warner was at 11.4 17 percent, and I'm going in descending order now. 18 AT&T, we've all heard of AT&T and what they do, 19 they're at 10 percent. Century Link, think of that 20 as U.S. West Embark, Century, pretty big company. 21 I think the fourth largest local exchange carrier 22 in the United States; they're at 5 percent. And --- Page 199: 1 now Securus brings up the rear at 1.4 percent. So 2 Verizon makes roughly 10 times what I make on a 3 comparable basis. Time Warner makes eight times 4 what I make. AT&T makes seven times what I make. 5 Century Link makes four times what I make. I'm 6 not saying that any of those are bad. I'm just 7 putting these things in the proper perspective in 8 terms of what we make bottom line after all of our 9 costs, and commissions does represent a 10 significant portion of our costs is a relatively 11 small number. 12 So we don't earn excessive profits. We 13 don't earn excessive profits. We don't earn 14 excessive profits. I said that three times for 15 the egregious and abusive and predatory kinds of 16 comments that come at us most of the time.

(***) The redacted data does not disclose Securus’ costs to process credit card transactions, but they must be below $9.95, both for the common sense reason that their competitors are able to charge less, and because some states like Alabama require Securus to charge less with no apparent ill effects. Securus reported 4,059,157 credit card transactions ranging from $5.00 to $6.95 in 2012. We calculate the average fee collected to be $6.82 and the median to be $6.95. For 2013, Securus reported 4,769,570 credit card transactions ranging from $3.00 to $9.95. We calculate the average fee collected to be $7.20 and the median to be $6.95.

What a bunch of thieves , stealing from the poor. Let’s face it there is more poor people in prison than rich . There is no need to gouge prices like they’re doing . I can no longer afford to talk to my husband in TDCJ . That does wonders for rehabilitation .

[…] obtained and published by the Huffington Post, and later reported by the New York Post and the Prison Policy Initiative, tell a different story. The slides show that Securus earned $114.6 million in profits in 2014, […]

Call Broda McAllister… he is an admin who helped get all 11 of my refunds they initially refused! Only took two Better Business Bureau complaints and hours of calls. (972) 277-0631

[…] profited from this structure. In 2014, Securus earned a 51 percent gross profit margin the biggest jump in years. Families must bear the undue financial burden of this injustice. Therefore, we have a […]

Another company out there scamming people is Inmate Call Solutions. They take your money and don’t provide you their service. So sad that there are companies like these taking advantage of people. Do your research before doing business with the company. I wish I had. Buyers beware.