Learn more about Dan Kopf, the newest member of Prison Policy Initiative's board.

by Alison Walsh,

July 25, 2016

We are pleased to welcome Dan Kopf to the Prison Policy Initiative board. Dan is a data scientist in California and a writer at Priceonomics who has been a member of our Young Professionals Network since February 2015. He is the co-author of several Prison Policy Initiative reports, including The Racial Geography of Mass Incarceration, Separation by Bars and Miles: Visitation in state prisons, Prisons of Poverty: Uncovering the pre-incarceration incomes of the imprisoned, and Detaining the Poor: How money bail perpetuates an endless cycle of poverty and jail time.

Why did you decide to join the Prison Policy Initiative board?

Dan Kopf: The Prison Policy Initiative does incredible work advocating for the end of mass incarceration and the humane treatment of those who are incarcerated – and they do it on a shoestring. I joined the board because I wanted to support, in whatever way possible, an organization I admire.

What does your work focus on? And what’s the connection between that work and the Prison Policy Initiative?

Dan Kopf: I am a data journalist focused on reporting statistical trends in society. Just like the Prison Policy Initiative, my work entails communicating complex topics clearly and in a manner that excites the public.

What do you think is most unique about the Prison Policy Initiative and the projects it takes on?

Dan Kopf: I have been most impressed by the dedication and combination of skills of the staff. This is a group of people that have the rare combination of communication skills, facility with technology and data, and passion.

A now-withdrawn proposal would have made Maryland the first state to ban letters to people in state facilities.

by Alison Walsh,

July 20, 2016

You may have missed it, but for a short time in Maryland, an alarming policy was on the table. The Maryland Department of Public Safety and Correctional Services proposed the first total ban on letters to incarcerated people in state facilities. Claiming that the prison system needed to stop the spread of drugs hidden in envelopes, prison officials recommended restricting all correspondence to postcards. Previously, only county jails had ever introduced such a shortsighted and counterproductive policy.

We documented the many reasons why postcards are not an acceptable substitute for letters from home in our 2013 report, Return to Sender: Postcard-only mail policies in jail. Families limited to postcards have no way to shield confidential information or attach drawings and photographs. Plus, regular correspondence by postcard is much less cost-effective. We calculated that each word written on a postcard is about 34 times more expensive to send than a word written on letter-sized paper.

Fortunately, the ACLU of Maryland responded swiftly. The civil liberties organization pointed out that a letter ban would have consequences far beyond the state’s prison walls.

The implications of such a sweeping regulation cannot be overstated. The policy you propose would affect not only the 21,000-plus people in your custody, but also the tens of thousands of Marylanders who are connected with them. The scheme would forbid a pastor from writing to a parishioner who is now incarcerated—indeed, it would forbid letters from organizations that provide all kinds of supportive services to those who are inside. The proposal would rob families of one of the most profoundly significant forms of communication in our society. Under the new scheme, an ailing mother could not send her son a letter for him to hold onto after she is gone. A teen could not write her mom to tell her the things she can’t say in a visit.

The negative publicity worked. Shortly after the ACLU of Maryland issued their response, the Maryland Department of Public Safety and Correctional Services withdrew the request.

The Department of Public Safety and Correctional Services is withdrawing its request for limiting mail to postcards for offenders in our facilities.

Secretary Stephen Moyer will form a focus group to determine the best options for eliminating contraband coming into our facilities through the mail.

The group will also research the most effective procedures to ensure the safety of our staff and those in our custody.

The withdrawal is a positive development, but, as the ACLU of Maryland points out, the proposal never should have been under serious consideration.

We are glad that the Department of Public Safety and Corrections is dropping an extreme proposal to ban incoming personal letters. But this should never have come up in the first place. The proposed ban comes on top of other changes that have harmed families’ ability to be in touch, like visitation rules. We are urging the Department to ensure that it is working in ongoing and meaningful partnership with families who can best advise the Department about how to ensure efforts to address security concerns do the least damage possible to families. The Department’s proposed workgroup is an excellent place to start.

For more on the now-defunct proposal, including the perspectives of formerly incarcerated people and their families, see the ACLU of Maryland’s full press release.

Two of the biggest players in the prison and jail commissary market are planning to merge: The corporate parent of Trinity Services Group will be acquiring Keefe Group.

by Stephen Raher,

July 5, 2016

Two of the biggest players in the prison and jail commissary market are planning to merge. In May, H.I.G. Capital (owner of food-service and commissary operator Trinity Services Group) announced that it would be acquiring Keefe Group, one of the largest for-profit operators of prison and jail commissaries. A combination of the two companies would make a formidable player in an industry that is already concentrated among a small number of firms.

Prison and jail commissaries are big business. As explained at the end of this article, we estimate that commissaries throughout the country rake in about $1.6 billion in sales each year. An increasing number of facilities are outsourcing commissary operations to for-profit companies like Keefe and Trinity. But these companies are privately held, and it’s hard to find hard data on their size and profit margins. This article discusses what we currently know about the commissary industry, and why the Keefe/Trinity merger should be a matter of concern to incarcerated people, their family members, and anti-trust regulators.

How many commissaries are outsourced to for-profit companies?

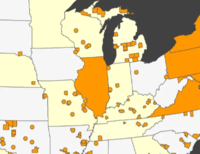

It’s hard to know how prevalent outsourcing is across all commissaries. In 2013, the Association of State Correctional Administrators (ASCA) conducted a survey of prison commissaries. Of the thirty-four state prison systems that responded to the survey, twelve (about one-third) reported some level of commissary privatization. Based on anecdotal evidence, privatization seems to be more common in county jails, which are smaller and thus lack the economies of scale that state prison systems can leverage.

When facilities do outsource commissaries, the contractor’s profits are driven not just by the sheer numbers of people incarcerated at any given time (about 2.3 million people), but also from the fact that, as facilities cut their budgets for food and subsistence, incarcerated people are forced to pay for basic necessities out of their own pockets. For example, when the Ohio prison system outsourced its food service operations, commissary orders increased dramatically, as people bought food to supplement what they were served in the cafeteria. Texas state prisons provide soap free of charge, but people must purchase their own toothpaste. And people incarcerated at the Denver jail have to buy their own underwear (which created some confusion, causing the Keefe-run commissary to short the county on its commission payments, according to an audit).

Notably, Keefe Group is not just a commissary company–it’s a network of six companies that operate various prison-related businesses. In addition to commissary operations, Keefe’s holdings include Inmate Calling Solutions (dba ICSolutions), a communications company that operates in prisons and jails (ICSolutions and H.I.G. filed a notice of the sale with the Federal Communications Commission on June 9, 2016).

What does the proposed merger mean for incarcerated people and their families?

As explained below, a combined Trinity/Keefe commissary company could, based on historical revenue figures, reap annual revenues of $875 million. This amounts to more than half of the total $1.6 billion commissary market. But the $1.6 billion figure includes government-run commissaries, so Trinity/Keefe’s share of the privatized commissary market would be far in excess of 50%. Calculating a precise number is not possible, both because it’s difficult to know what percentage of commissaries are privatized, and because Trinity’s revenue figures include money from non-commissary food-service contracts (Keefe’s numbers, as explained below, are based only on Keefe’s commissary subsidiary).

A review of recent procurement actions by jails looking to outsource their commissary operations suggests that there are three dominant companies in this market: Keefe, Trinity, and Aramark. Because jails often receive a commission (kickback) from commissary operators, the same economic distortions that plague the prison phone industry are also at play in commissaries: the winning bidder isn’t necessarily the company that offers the lowest prices for incarcerated people and their families. Nonetheless, reduced competition will only make things worse. Those facilities that do want to negotiate for fair pricing will have less leverage, and higher prices are a distinct possibility.

In their joint filing with the FCC, Keefe and H.I.G. argue that the acquisition “will serve the public interest by providing additional capital to [ICSolutions], which in turn will enhance its ability to maintain and improve its network and services.” What this self-serving statement fails to address is whether ICSolutions (or any other Keefe Company) actually lacks adequate capital. The answer is probably no. Given the market shares of Trinity and Keefe, the proposed transaction seems to be motivated by a desire to dominate the market–something that antitrust regulators should closely scrutinize.

Explaining the math

Because there is no authoritative data source for prison and jail commissary sales, we used the 2013 ASCA survey as our starting point. In that survey, twenty-eight states reported total annual sales of $517.5 million (the profits in those states totals upwards of $57 million), which equals annual sales of $674 per incarcerated person.1

To estimate commissary sales in the states that did not report figures to ASCA, we multiplied the average per capita figure of $674 by the total prison population of the twenty-two non-reporting states, which yields estimated sales of $348 million.

To estimate the size of the jail commissary market, we calculated the per capita sales figures for seven counties where financial information was publicly available.2 The average per capita revenue for these seven counties is $782. We multiplied that amount by the total national jail population of 646,000, resulting in a total jail market of $505 million.

Finally, we added the Federal Bureau of Prisons’ commissary sales (as reported to ASCA).

Adding up all of the aforementioned categories results in a total commissary revenues of $1.6 billion per year, as follows:

| State prison sales reported to ASCA (28 states) |

$517 million |

| 22 remaining states (estimated) |

$348 million |

| Jails (estimated) |

$505 million |

| Federal BOP sales reported to ASCA |

$259 million |

| TOTAL |

$1.6 billion |

As far as sales for Keefe and Trinity are concerned, both companies are privately held, and therefore financial information is hard to come by. But in a 2015 bid for an Arizona contract, Trinity claimed annual revenues of over $500 million (this comes both from commissary operations and general food-service contracts), and a captive customer base of approximately 475,000 incarcerated people spread throughout 700 facilities in 44 states.

In 2014, Keefe Commissary Network (one of the Keefe Group companies) bid to operate the commissary system for the West Virginia Division of Corrections. The company’s proposal included 2012 financial statements for the commissary subsidiary, reporting total sales of $375 million, with a net profit of $41 million. This equates to a 10.9% profit margin, which is quite robust (as a point of comparison, Wal-Mart’s profit margin is around 3%).

Based on these historical numbers, combined sales for the two companies could top $875 million. That’s equivalent to controlling every commissary in every state prison.