The CFPB’s enforcement order against prison profiteer JPay, explained

The company was fined $6 million for exploiting people leaving prison.

by Wanda Bertram, October 28, 2021

Last week, the Consumer Financial Protection Bureau fined JPay, a prison services provider, $6 million for exploiting people leaving prison. Below, we explain why the Bureau’s enforcement order against JPay — which builds on some arguments we made in 2015 — is a victory for criminal justice reform.

JPay is a private company widely known for selling video calls, emails and other technology to incarcerated people, but it has a less-well-known business providing pre-paid debit cards to incarcerated people upon release. This update concerns that last business.

We’ve previously discussed how a growing number of prisons force people leaving custody to receive money — such as wages earned inside, unused “trust account”1 balances, or small reentry stipends — on pre-paid debit cards riddled with high fees. The companies issuing these “release cards,” including JPay, have imposed fees for checking one’s account balance at an ATM, making a purchase, closing an account, and simply having an account at all, eating up formerly incarcerated people’s meager account balances.

The CFPB’s enforcement order against JPay will protect many people from these unreasonable and unjust fees going forward. The order takes four important steps:

- The order prevents JPay from charging any fees on release cards in the future, other than an “inactivity fee” that can only be triggered after someone does not use their account for 90 days. For JPay customers, the complex matrix of extraneous fees is now gone, hopefully forever (though the consent order does expire after five years).

- The order affirms that the CFPB has the jurisdiction to regulate release cards under the Electronic Fund Transfer Act, basically staking a claim for the Bureau to oversee JPay and other release-card issuers and take enforcement action when necessary. (In 2016, when the CFPB was conducting a rulemaking concerning prepaid cards, the Prison Policy Initiative brought the growing use of release cards to the agency’s attention.)

- The order clarifies that under the Electronic Fund Transfer Act, people being released from prison cannot be forced to receive “gate money” (stipends for reentry) on prepaid debit cards. Instead, people must be given multiple options for receiving gate money, such as a paper check or cash. The CFPB has previously noted that the same protection applies to wages earned in prison, but it’s not entirely clear how this works with accumulated wages that are paid out in a lump sum when someone leaves custody.

- The order spells out in detail how some of JPay’s business practices are unfair or abusive under the Dodd-Frank Act. This part of the order may prove critical for lawyers and activists fighting for further consumer protections for incarcerated people: Dodd-Frank prohibits unfair, deceptive, or abusive practices, but these are broad terms that need refinement, and the CFPB’s order provides that kind of refinement so that advocates can hone their strategies.

Readers who want further reading on this topic, particularly journalists, might find the following resources helpful:

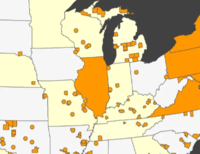

- Our 2015 report/comment letter Curbing the exploitation of people released from custody, which we submitted to the CFPB during a rulemaking period, explains the problems with release cards, names the biggest release card providers (including JPay), and argues that the CFPB has the authority to regulate these companies.

- Our blog post “A partial victory: release cards included in CFPB’s new regulations” sums up what the CFPB did — and didn’t do — to regulate release cards during its 2015-16 rulemaking.

- Our page of research on exploitative in-prison services, including telecom services, commissary, and prison banking may provide further ideas.

- The Consumer Financial Protection Bureau’s searchable database of consumer complaints may help journalists looking for leads as they report on this issue.

- Contractual terms for all prepaid debit cards (including release cards), available in a searchable database maintained by the CFPB.

Footnotes

-

The term “trust account” is a term of art in the correctional sector, referring to a pooled bank account that holds funds for incarcerated people whose individual balances are sometimes treated as subaccounts. The term “trust” is used because the correctional facility typically holds the account as trustee, for the benefit of the individual beneficiaries (or subaccount holders). ↩