Insufficient funds: How prison and jail “release cards” perpetuate the cycle of poverty

We examined release card companies’ fee structures to learn how this industry has evolved, and what government leaders can do to stop its worst practices.

by Stephen Raher, May 3, 2022

Every year, roughly 5 million people are released from jail and another half million leave prison. But just because they are released from physical custody doesn’t mean that they are free of the financial exploitation resulting from that experience.

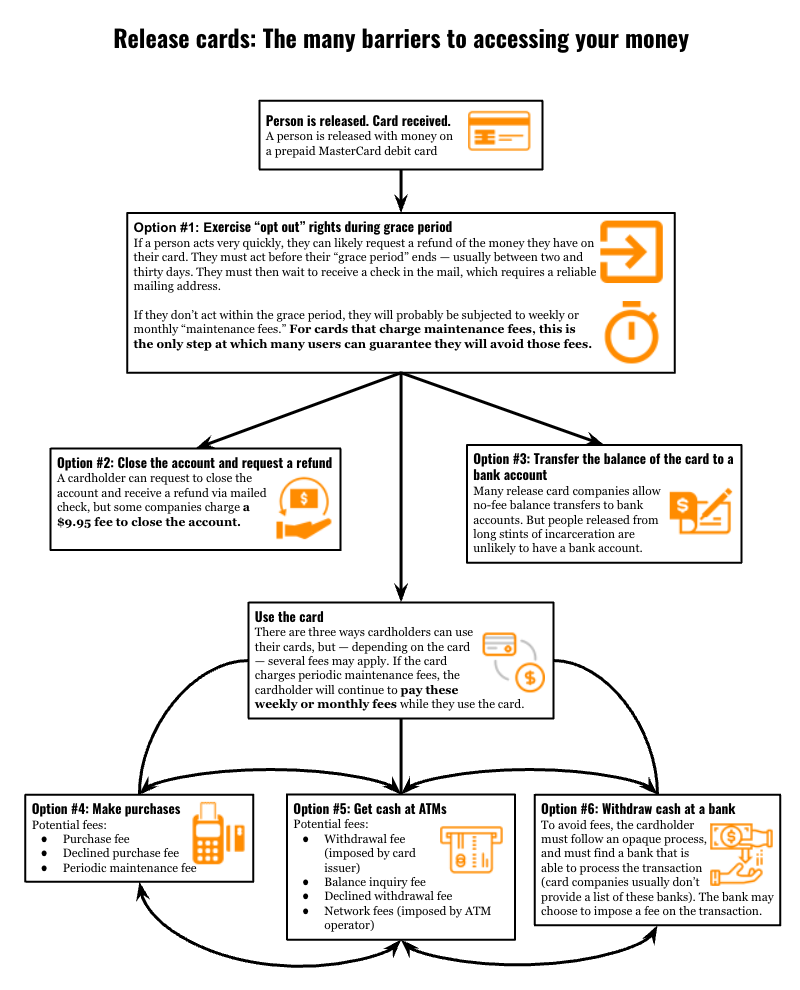

When a person leaves a correctional facility, they often receive their funds — wages earned while behind bars, support from family members, or money the person had in their possession when arrested — on fee-laden prepaid debit cards. As we explain below, there are several ways (six, to be precise) to get money off of a release card, but they are expensive, difficult, or both.

We first put a spotlight on these “release cards” in 2015, when they came on the scene as one of the newer ventures from companies that have traditionally profited by charging incarcerated people and their families exorbitant rates for phone calls, money transfers, or other technological services. While release cards were novel in 2015, they are now ubiquitous. Since then, the Consumer Financial Protection Bureau (CFPB) has reined in some of the industry’s worst practices and cracked down on one of the biggest players in the industry, but these companies continue to line their pockets at the expense of low-income individuals who are trying to navigate the reentry process. As the CFPB’s director recently noted, some release-card companies have made a practice of “siphoning off…people’s own hard-earned money” through abusive practices that sometimes violate federal law.

To better understand how these companies continue to unfairly extract money from consumers — and more importantly, what can be done to stop them — we analyzed the most recent fee disclosures that release-card companies filed with the CFPB. The data (which are summarized in the appendix1) paint a picture of a complex obstacle course, riddled with pitfalls that deprive formerly incarcerated people of the modest amount of money they have when they are released.

The six ways release-card companies grab people’s money

When someone is given a release card on their way out of a prison or jail, they have up to six ways to use its value, but each option entails different challenges, and most involve fees.

Option #1: Opt out (but the clock starts ticking at the moment of release)

The first way someone can get their money off of a release card is by exercising their right to “opt out” and get a refund.

While this may sound easy, it will come as no surprise that release-card companies make it difficult (or nearly impossible) for recently released people to exercise their opt-out rights. Cardholders face four primary hurdles:

- First, the cardholder must act quickly. They have to notify the company they want a refund within an arbitrary “grace period” to avoid being hit with maintenance fees. These grace periods are generally between two and thirty days, creating an unnecessary obstacle at a time when the cardholder is trying to secure housing and employment, and (if on parole) comply with terms of supervised release.2

- Second, opting out generally requires that the cardholder call customer service or make a web-based request to close the account. The problem here is that people recently released from custody frequently lack reliable phone or internet service.

- Third, the cardholder cannot use the card for even a single transaction, effectively freezing their money at a time when they need it most.

- Finally, refunds are generally sent via a mailed check, even though recently released people are likely to need time to establish a mailing address and are unlikely to be able to wait for the time required under the U.S. Postal Service’s degraded delivery standards.

A full breakdown of fees charged by each card type is available in the appendix.

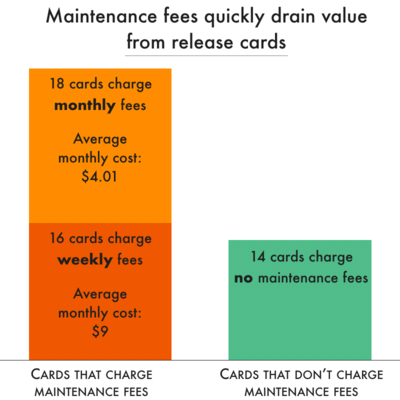

If someone receives a release card that charges a periodic maintenance fee and they do not close their account within the grace period, then the maintenance fees will be deducted from their card balance every week or month. Almost three-quarters of the release-cards we reviewed charge “account maintenance” fees.

Option #2: Close the account after the opt-out period has expired

After the grace period has expired, a cardholder can request that the account be closed and receive a refund via mailed check. Seventeen release cards (all managed by Numi Financial) charge a steep $9.95 fee for this service, meaning anyone with a balance of less than $10 can’t take advantage of this option. Someone with a $50 balance can use this option, but effectively has to pay a fee of 20% for a very simple transaction.

Option #3: Transfer the money to a bank account (if you have one)

Some cardholders can transfer their balance to a bank account. Two of the three dominant release card brands (Access Corrections and Numi) appear to allow cardholders to transfer their funds to a bank account without paying a fee.3 However, the companies do not provide much detail about how to do this, beyond referring consumers to the program manager’s website. While this may be useful for cardholders with bank accounts, most people being released from long terms of incarceration don’t have bank accounts, effectively eliminating this option for them.

Option #4: Use the card to make purchases

Holders of release cards can use their balances to make in-store or online purchases. This only works if the business in question accepts Mastercard. While many retailers do, some important businesses (like landlords) do not.

But even if a cardholder wants to use the card at a Mastercard-accepting business, simply using the card for purchases can subject them to a whole new series of fees. Some cards charge users for each purchase (seven cards levy such fees, averaging 71¢ per transaction). These fees are hard to justify because card companies are already compensated for the cost of processing transactions through interchange fees paid by merchants.4

Half of the cards we examined charge fees for declined transactions, with an average fee of 62¢. These fees are even more difficult to justify because it doesn’t appear that card issuers incur any expense when a purchase request is declined. These fees seem to be nothing more than corporate enrichment at the expense of consumers who are least able to absorb these costs.

Finally, don’t forget that for cards with periodic maintenance fees, the longer it takes the consumer to spend down their balance, the more they will pay in weekly or monthly maintenance fees.

Option #5: Get cash at an ATM

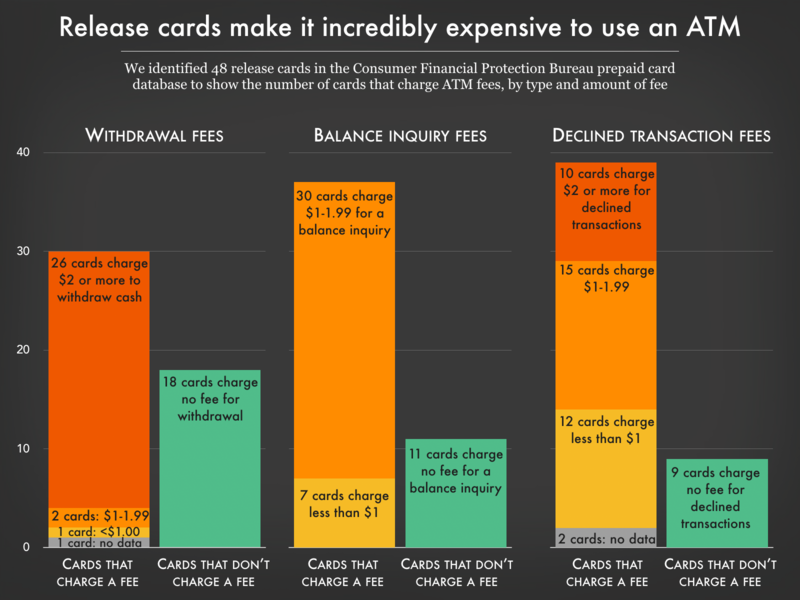

Getting cash from an ATM also presents its own challenges and fees.

Some card companies offer a network of ATMs where customers can withdraw their money for free, or a relatively low fee. However, if the cardholder uses an ATM outside of this network, they’re likely to be hit with fees by both the card issuer and the bank that operates the ATM. Twenty-nine release cards (60% of our data set) impose fees for ATM withdrawals — with an average fee of $2.58 per transaction. Sometimes these fees apply only to out-of-network ATMs, but some cards charge the fee for all ATM transactions.

Finally, twenty-four cards impose a fee for declined ATM transactions (with an average fee of 62¢). To avoid a declined-ATM-withdraw fee, a cardholder may want to check their available balance, but doing that at an ATM carries a fee — ranging from 50¢ to $1.50 — on thirty-seven release cards (77% of the data set).

Option #6: Withdraw cash at a bank

Over-the-counter withdrawals appear to often be fee-free, but figuring out how to use this option can be nearly impossible. For example, the cardholder agreement for Axiom Bank’s release cards (branded as Access Corrections cards) states that cardholders must perform over-the-counter withdrawals at a “MasterCard principal financial institution,” but neither Axiom or Mastercard itself provides information on how to determine which bank branches fall within this category. Similarly, Central Bank of Kansas City (a partner with Numi Financial) also fails to inform customers where they can make over-the-counter withdrawals, but cardholder materials do warn that banks offering this service may impose their own fees.

Making release cards work for recently released people

All too often, correctional facilities use release cards without giving any thought to the experience of the person being released from custody. For a short stint in jail — a few days or hours — simply returning a person’s cash to them upon release is almost always the best option. If someone spends a longer time in custody, though, and accumulates a balance in their “trust account,” a prepaid debit card may be a convenient way to give someone their money, especially if there are few (or no) fees and cardholders have free and easy-to-use options to transfer the balance or turn it into cash.

The real problem here isn’t release cards themselves; it’s the abusive fees and practices that are common in the industry today.

Correctional agencies can take steps to end some of the most outrageous release-card practices. For example, we identified one release card in the CFPB database that stands out in a good way: the Comerica Bank card used by the North Dakota Department of Corrections. This card has relatively few fees compared to other companies: just an inactivity fee of $2/month that kicks in if the card hasn’t been used for twelve consecutive months, a $10 fee for expedited replacement of a lost card via overnight mail (a replacement card via first-class mail is free), and a few ATM fees.5 It’s also the only card we reviewed that doesn’t include a mandatory arbitration provision. How did such a small prison system get such a good deal? Because the North Dakota Department of Corrections joined with other state agencies that use prepaid debit cards (for payments like unemployment benefits) to negotiate a group contract with decent consumer protections. It’s a practice more states can and should adopt.

State legislatures can also crack down on bad release-card deals. We’ve drafted simple model legislation that prevents most of the worst practices in the industry.

Finally, the federal government has a role to play in making these cards work better for consumers. The CFPB is currently looking at “junk fees” charged in connection with consumer financial products. These are fees that don’t serve any real purpose other than to pad the bottom lines of the companies that charge them. We filed comments asking the CFPB to finish the work it started when it fined JPay last year. We encouraged the agency to crack down on some of the worst practices across the release card industry, in addition to addressing the equally abusive fees charged for money transfers to incarcerated people.

Release cards shouldn’t be a tool for taking money from those who can least afford it. Prison and jail officials, along with state and federal leaders, have a responsibility to ensure the little bit of money that recently released people have is not quickly drained by hidden or inescapable fees. States and counties should follow the lead of North Dakota by leveraging their power to negotiate a contract that minimizes fees; state legislatures should prohibit the industry’s worst practices; and the CFPB should continue to police companies in this sector.

Appendix

| Account Maintenance Fees | Transaction Fees | ATM Fees | Inactivity Fees and Policies | Other Information | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CFPB Database ID | Issuer | Program Manager | Correctional Agency | Weekly Fee | Monthly Fee | Grace Period | Purchase Fee | Declined Purchase | Balance Inquiry | Withdrawal | Declined Transaction | Inactivity Fees and Policies | Inactivity Period | Fee to Refund/Close Account | Miscellaneous Fees | Effective Date of Cardholder Agreement | ||||||

| C 10 AF Legacy (158574) | Axiom Bank | Rapid Financial | 2.50 | 3 days | — | — | 1.50 | 2.95 | 2.95 | — | — | card replacement (2.99) | 1/10/20 | |||||||||

| C 10 Legacy AF ALDOC (158575) | Axiom Bank | Rapid Financial | Alabama DOC | 1.50 | 5 days | — | — | 1.50 | 2.75 | 2.75 | — | — | card replacement (2.99) | 1/10/20 | ||||||||

| C 11 AF ALDOC WR1 (158576) | Axiom Bank | Rapid Financial | Alabama DOC | — | — | — | — | — | 1.50 | 2.95 | 2.95 | 2.00/week | 90 days | — | card replacement (2.99) | 1/10/20 | ||||||

| C 12 AF WR NMF (158577) | Axiom Bank | Rapid Financial | — | — | — | — | — | 1.50 | 2.95 | 2.95 | 2.00/week | 90 days | — | card replacement (2.99) | 1/10/20 | |||||||

| C 13 AF AL DOC (158578) | Axiom Bank | Rapid Financial | Alabama DOC | 1.50 | 5 days | — | — | 1.50 | 2.75 | 2.75 | — | — | card replacement (2.99) | 1/10/20 | ||||||||

| C 14 Legacy AF (158579) | Axiom Bank | Rapid Financial | 2.50 | 3 days | — | — | 1.50 | 2.95 | 2.95 | — | — | card replacement (2.99) | 1/10/20 | |||||||||

| C 15 NV DOC (158580) | Axiom Bank | Rapid Financial | Nevada DOC | 1.50 | 3 days after activiation (or 90 days after issuance, if not activated) | — | — | 1.50 | 2.75 | 2.75 | — | — | card replacement (2.99) | 1/10/20 | ||||||||

| C 18 IA DOC (158581) | Axiom Bank | Rapid Financial | Iowa DOC | — | — | — | — | — | 1.50 | 2.95 | 2.95 | 2.00/week | 180 days | — | card replacement (2.99) | 1/10/20 | ||||||

| C 20 GEO Legacy (158582) | Axiom Bank | Rapid Financial | GEO Group | — | — | — | — | — | — | — | — | 2.00/week | 180 days | — | — | 1/10/20 | ||||||

| C 22 CADDO PARISH WR (158583) | Axiom Bank | Rapid Financial | Caddo Parish (LA) | 2.00 | 3 days | — | — | 1.50 | no ATM usage allowed | — | — | card replacement (2.99) | 1/10/20 | |||||||||

| C 40 RP (158584) | Axiom Bank | Rapid Financial | 2.50 | 3 days | — | — | 1.50 | 2.95 | 2.95 | — | — | card replacement (2.99) | 1/10/20 | |||||||||

| C 45 Legacy RP (158585) | Axiom Bank | Rapid Financial | 2.50 | 3 days | — | — | 1.50 | 2.95 | 2.95 | — | — | card replacement (2.99) | 1/10/20 | |||||||||

| Elan Prepaid (44557) | US Bank | — | Nebraska DOCS | — | — | — | — | — | 1.00 (out of network only) | 1.25 (out of network only) | — | 2.00/mo | 270 days | not disclosed | Card replacement (5.00, or 10.00 for expedited), int’l (vars) | 10/12/21 | ||||||

| Elan Prepaid (44555) | US Bank | — | Arkansas DOC; Hampden County | 2.00 | none listed | — | — | 0.50 (out of network only) | 0.99 (out of network only) | — | — | not disclosed | Card replacement (5.00), bank withdrawal (3.00) | 10/12/21 | ||||||||

| ND-Department of Corrections (46984) | Comerica | — | North Dakota DOC | — | — | — | — | — | — | 1.25 (out of network only) | — | 2.00/mo | 12 months | Expedited card replacement ($10) | 4/1/19 | |||||||

| Prestige Prepaid Mastercard version 1B (199643) | Central Bank of Kansas City | Numi Financial | 2.50 | 3 days | — | 0.50 | 1.00 | 2.95 | 1.00 | — | 9.95 | 4/6/20 | ||||||||||

| Prestige Prepaid Mastercard version 1C (199644) | Central Bank of Kansas City | Numi Financial | 2.50 | 3 days | — | 0.50 | 1.00 | 2.95 | 1.00 | — | 9.95 | 4/6/20 | ||||||||||

| Prestige Prepaid Mastercard version 1CNO (199645) | Central Bank of Kansas City | Numi Financial | 2.50 | 3 days | — | — | 1.00 | 2.95 | 1.00 | — | 9.95 | 9/24/20 | ||||||||||

| Prestige Prepaid Mastercard version 3B (199646) | Central Bank of Kansas City | Numi Financial | 2.50 | 3 days | 0.95 (PIN only) | 0.50 | 1.00 (out of network only) | — | 1.00 | — | 9.95 | 4/6/20 | ||||||||||

| Prestige Prepaid Mastercard version 4B (199647) | Central Bank of Kansas City | Numi Financial | 2.50 | 7 days | — | 0.50 | 1.00 | — | 1.00 | — | 9.95 | 4/6/20 | ||||||||||

| Prestige Prepaid Mastercard version 6B (199648) | Central Bank of Kansas City | Numi Financial | 2.50 | 2 years | 1.00 (PIN only) | 0.50 | 1.00 | 2.95 | 1.00 | — | 9.95 | 4/6/20 | ||||||||||

| Prestige Prepaid Mastercard version 7B (199649) | Central Bank of Kansas City | Numi Financial | 5.95 | 5 days | — | 0.50 | 1.00 | 2.95 | 1.00 | — | 9.95 | 4/6/20 | ||||||||||

| Prestige Prepaid Mastercard version 7C (199650) | Central Bank of Kansas City | Numi Financial | 5.95 | 5 days | — | 0.50 | 1.00 | 2.95 | 1.00 | — | 9.95 | 4/6/20 | ||||||||||

| Prestige Prepaid Mastercard version 7CNO (199651) | Central Bank of Kansas City | Numi Financial | 5.95 | 5 days | — | — | 1.00 | 2.95 | 1.00 | — | 9.95 | 4/6/20 | ||||||||||

| Prestige Prepaid Mastercard version 7D (199652) | Central Bank of Kansas City | Numi Financial | 5.95 | 15 days | — | 0.50 | 1.00 | 2.95 | 1.00 | — | 9.95 | 4/6/20 | ||||||||||

| Prestige Prepaid Mastercard version DOC1 (199653) | Central Bank of Kansas City | Numi Financial | — | — | — | — | — | — | — | — | — | — | 4/6/20 | |||||||||

| Prestige Prepaid Mastercard version DOC2 (199654) | Central Bank of Kansas City | Numi Financial | 2.50 | 60 days | — | — | 1.00 (out of network only) | — | 1.00 | — | — | 4/6/20 | ||||||||||

| Prestige Prepaid Mastercard version DOC3 (199655) | Central Bank of Kansas City | Numi Financial | 5.95 | 5 days | — | 0.50 | 1.00 | 2.95 | 1.00 | — | 9.95 | 4/6/20 | ||||||||||

| Prestige Prepaid Mastercard version DOC4 (199656) | Central Bank of Kansas City | Numi Financial | — | — | — | — | 0.50 | 1.00 (out of network only) | — | 0.95 | 3.00/mo | 180 days | 9.95 | 11/17/20 | ||||||||

| Prestige Prepaid Mastercard version DOC5 (199657) | Central Bank of Kansas City | Numi Financial | 5.95 | 60 days | — | 0.50 | 1.00 (out of network only) | — | 0.95 | — | 9.95 | 4/6/20 | ||||||||||

| Prestige Prepaid Mastercard version FSPA (199658) | Central Bank of Kansas City | Numi Financial | — | — | — | — | 0.50 | — | — | 0.95 | 1.95/mo | 180 days | — | 4/6/20 | ||||||||

| Prestige Prepaid Mastercard version SPA (199659) | Central Bank of Kansas City | Numi Financial | 4.95 | 30 days | — | 0.50 | 1.00 (out of network only) | 2.95 (out of network only) | 0.95 | — | 9.95 | 4/6/20 | ||||||||||

| Prestige Prepaid Mastercard version SPA15 (199660) | Central Bank of Kansas City | Numi Financial | 5.95 | 15 days | — | 0.50 | 1.00 (out of network only) | — | 0.95 | — | 9.95 | 4/6/20 | ||||||||||

| Prestige Prepaid Mastercard version WKA (199661) | Central Bank of Kansas City | Numi Financial | 2.50 | 3 days | 0.45 (PIN only) | 0.50 | 1.00 | 2.95 | 1.00 | — | 9.95 | 4/6/20 | ||||||||||

| JPay California (46811) | Metropolitan Commercial Bank | Praxell, Inc. | California | 3.00 | 7 days | Unknown | 1.00 | — | Unknown | 1.00 | — | Unknown | 4 other types of fees noted on short form disclosure | 2/9/21 | ||||||||

| JPay Colorado (46828) | Metropolitan Commercial Bank | Praxell, Inc. | Colorado | 0.50 | 7 days | 0.70 | 0.50 | 0.50 | 2.00 | 0.50 | 2.99/mo | 90 days | Unknown | Phone cust serv. ($1); 5 other types of fees noted on short-form disclosure | 2/9/21 | |||||||

| JPay Florida (46829) | Metropolitan Commercial Bank | Praxell, Inc. | Florida; New York work release; Tennessee work release | — | — | — | — | — | — | — | — | — | — | 2/9/21 | ||||||||

| JPay Georgia (46830) | Metropolitan Commercial Bank | Praxell, Inc. | Georgia, Arizona, Lousiana | — | — | — | — | — | — | — | — | 3.00/mo | 90 days | — | 2/9/21 | |||||||

| JPay Kentucky (46832) | Metropolitan Commercial Bank | Praxell, Inc. | Kentucky | Unknown | — | — | 0.50 | 0.50 | 2.00 | 0.50 | 2.99/mo | 90 days | Unknown | 7 other types of fees noted on short-form disclosure | 2/9/21 | |||||||

| JPay Milwaukee (46834) | Metropolitan Commercial Bank | Praxell, Inc. | Milwaukee, WI | — | 6.00 | 7 days | — | 0.50 | — | — | 0.50 | — | Unknown | 5 other types of fees noted on short form disclosure | 4/1/21 | |||||||

| JPay Missouri (46839) | Metropolitan Commercial Bank | Praxell, Inc. | Missouri | Unknown | — | — | 1.95 | 1.50 | — | Unknown | 2.99/mo | 90 days | Unknown | Card replacement ($5); 5 other types of fees noted on short-form disclosure | 2/10/21 | |||||||

| JPay MN (46840) | Metropolitan Commercial Bank | Praxell, Inc. | Indiana, Tennessee | — | 2.00 | 7 days | 0.70 | 1.00 | — | 2.00 | 1.00 | 2.99/mo | 90 days | Unknown | 6 other types of fees noted on short-form disclosure | 2/24/21 | ||||||

| JPay New Jersey (46835) | Metropolitan Commercial Bank | Praxell, Inc. | New Jersey | 2.00 | — | 7 days | — | — | — | — | — | — | — | Card replacement ($5) | 2/24/21 | |||||||

| JPay New York (46836) | Metropolitan Commercial Bank | Praxell, Inc. | New York | — | 2.00 | 7 days | 0.50 | 1.00 | 0.50 | 2.00 | 0.70 | — | Unknown | 8 other types of fees noted on short-form disclosure | 4/10/21 | |||||||

| JPay New York 2 (188075) | Metropolitan Commercial Bank | Praxell, Inc. | Unknown | — | 7 days | — | 0.50 | 0.50 | — | 0.70 | 2.99/mo | 90 days | Unknown | 9 other types of fees noted on short-form disclosure | 4/10/21 | |||||||

| JPay Ohio (46837) | Metropolitan Commercial Bank | Praxell, Inc. | Ohio | — | 1.00 | 7 days | — | Unknown | 0.50 | — | 0.50 | 3.00/mo | 90 days | Unknown | Card replacement ($8); 5 other types of fees noted on short-form disclosure | 4/1/21 | ||||||

| JPay Oklahoma (46838) | Metropolitan Commercial Bank | Praxell, Inc. | Oklahoma, North Carolina | — | 6.00 | 7 days | — | Unknown | — | — | Unknown | — | Unknown | Card activation ($3); card replacement ($6); 3 other types of fees noted on short-form disclosure. | 2/24/21 | |||||||

| JPay (TN, IN, VA) (46841) | Metropolitan Commercial Bank | Praxell, Inc. | Tennessee, Indiana, Virginia | — | 0.50 | 30 days | 0.70 | 0.50 | 0.50 | 2.00 | 0.50 | 2.99/mo | 90 days | 9.95 | Phone cust serv. ($1), card replacement ($5) | 6/16/20 | ||||||

Footnotes

-

It appears the data JPay filed with the CFPB may be out of date. Last year, the company signed a consent order with the CFPB banning it from charging most fees, however it has not updated its filings with the Bureau. For this analysis, we’ve used the most recent filings from the company, even though they are likely out of date, because they reflect the state of the market prior to the enforcement action, and where the market may return upon the expiration of the consent order in 2026. ↩

-

Not only are grace periods arbitrary, but they likely have a more troublesome purpose, as we explain in our recent filing with the CFPB. Consumer-rights activists have had a fairly good track record suing release-card companies for various legal violations. The companies try to keep these suits out of court by relying on the arbitration provisions in the fine-print terms of service, but most courts that have confronted these disputes have held the arbitration provisions unenforceable because cardholders do not voluntarily agree to them. Grace periods are likely an industry strategy to defeat future litigation: by offering someone a few days to opt out of using a card, the company can then argue that anyone who doesn’t opt out has “voluntarily” agreed to all the terms and conditions buried in the card’s fine print. ↩

-

We assume the third company, JPay, doesn’t charge a fee to transfer money to a bank account under the terms of the CFPB consent order. However, as explained in footnote 1, we can’t be certain of this because the company has not updated its filings with the CFPB. ↩

-

Mastercard rules specify that costs of operating the network are to be borne by the financial institutions that are members of the Mastercard network. Thus, collecting fee revenue from cardholders for processing purchase transactions looks like a form of double recovery. See Mastercard Rules S 3.4 (Dec. 7, 2021). ↩

-

There is a $1.25 for out-of-network ATM withdrawals, but cardholders get two free out-of-network withdrawals each month. There are also fees for ATM transactions outside the U.S, which is fairly common across most prepaid cards. Even with these fees, when examined as a whole and compared to other release cards being used, the North Dakota fee structure seems fairly good. ↩

This veteran of several releases from English and Scottish prisons is disgusted but unsurprised that the US prison system has made even the accessing of newly-released prisoners’ own funds a matter for corporate profit-making. Here, it is still very much cash that is handed to a prisoner at Reception. The process is emotional, filled with a combination of eager anticipation and anxiety over the new life that is beginning. Thankfully it is not tainted by a feeling of being ripped off by some faceless financial corporation.

Of course, there is no good reason why British or US prisons can’t transfer funds directly into the prisoner’s bank account. Our prisons encourage all inmates without such accounts to set them up before release and provide the means to do so.